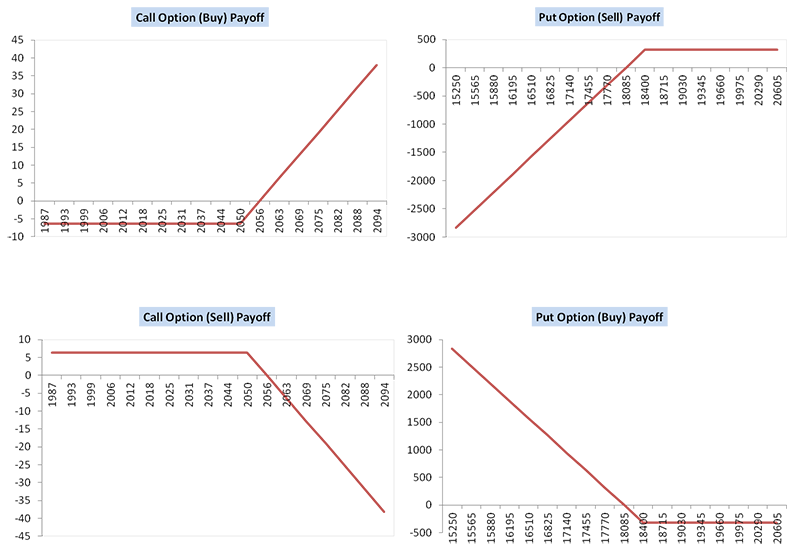

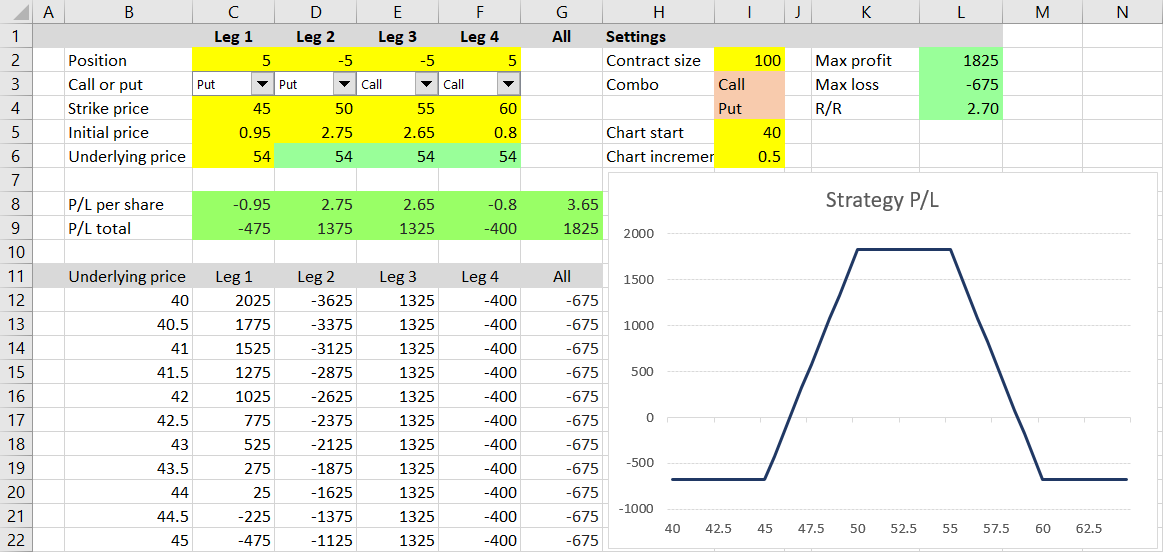

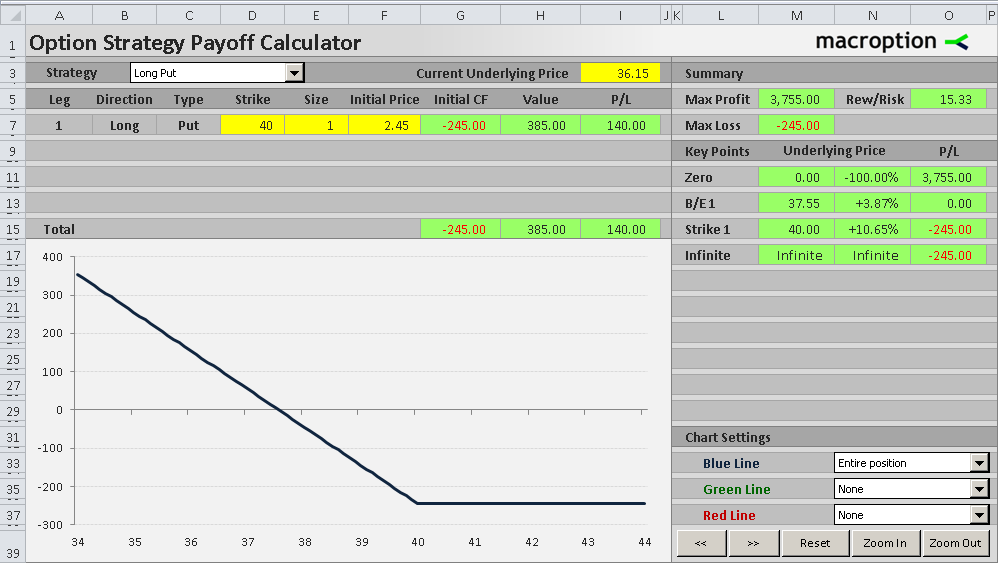

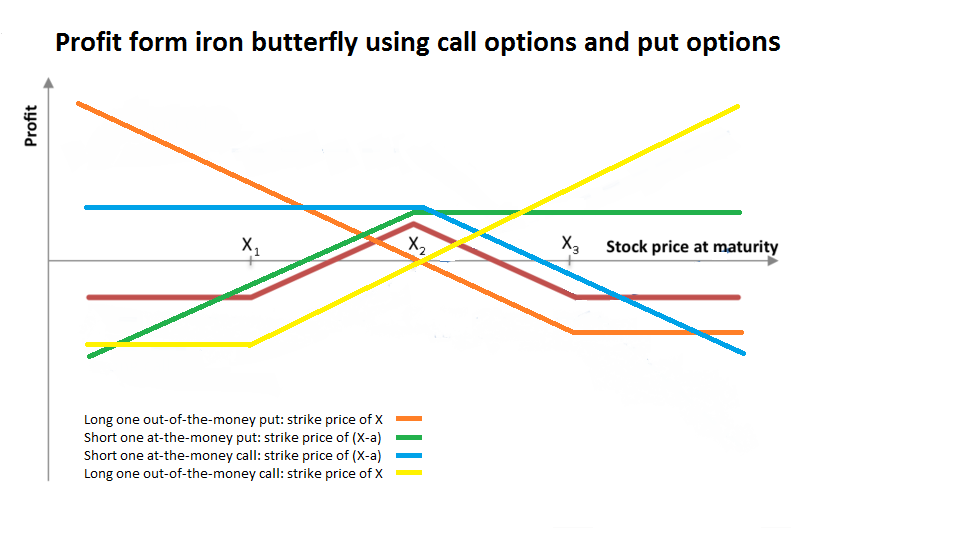

Just enter the amounts of options combined with the amount of underlying assets 44, Value number, Price of underlying, Payoff from first call position, Payoff. 2. 3, Type, Call, Call, Call, Call, Option Multiplier, 4, Volume, 1, -1, -1, 1, Graph Centre, 5, Strike, 98, 99, , , Graph Increment, 1.

6, Price, , This is part 5 of the Option Payoff Excel Tutorial, which will demonstrate how to draw an option strategy payoff diagram in Excel. In the previous four parts we.

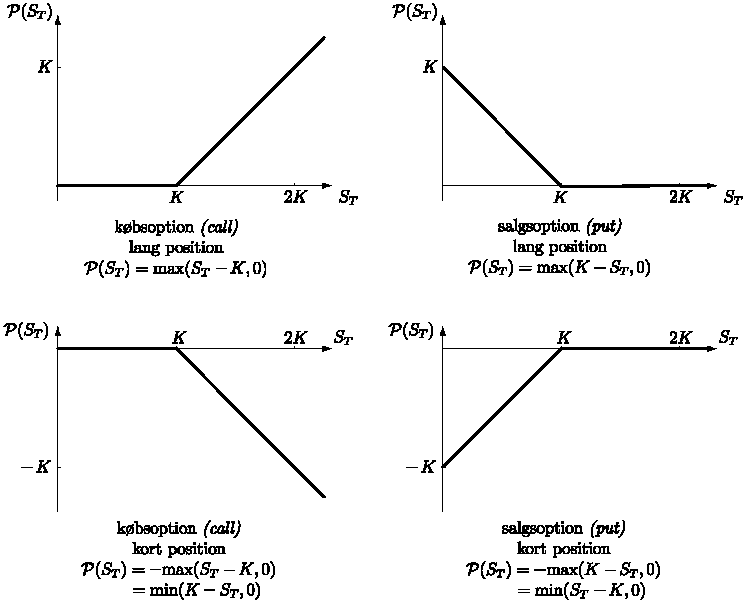

Just enter the amounts of options combined with the amount of underlying assets 44, Value number, Price of underlying, Payoff from first call position, Payoff. Helpful Hint: In the diagrams that follow, the ‘KINKS’ are at strike prices.

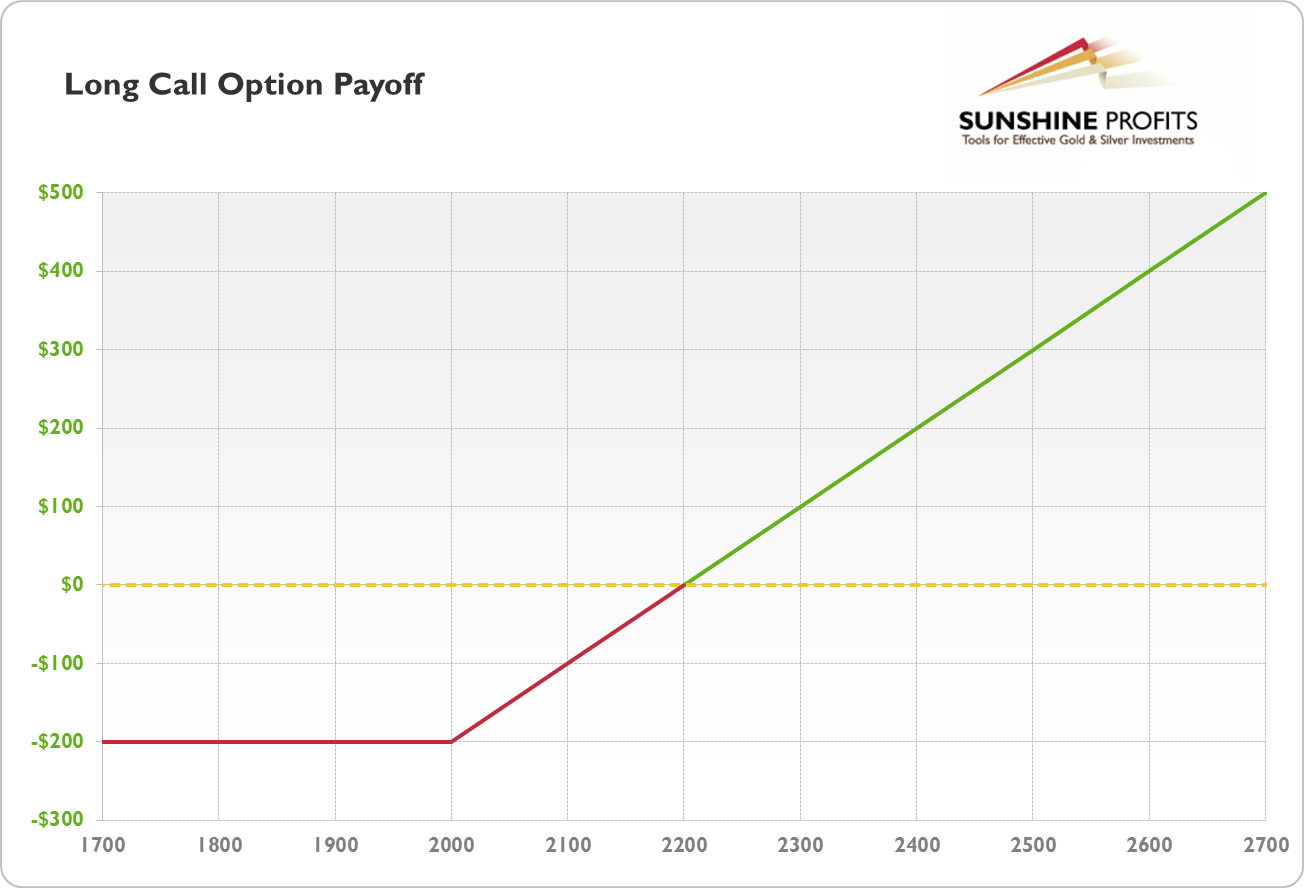

. If the underlying price is $76 at expiration, your payoff is $, and your loss (CF0 +.Technical Analysis; Technical Analysis; Technical Indicators; Neural Networks Trading; Strategy Backtesting; Point and Figure Charting; Download Stock Quotes.

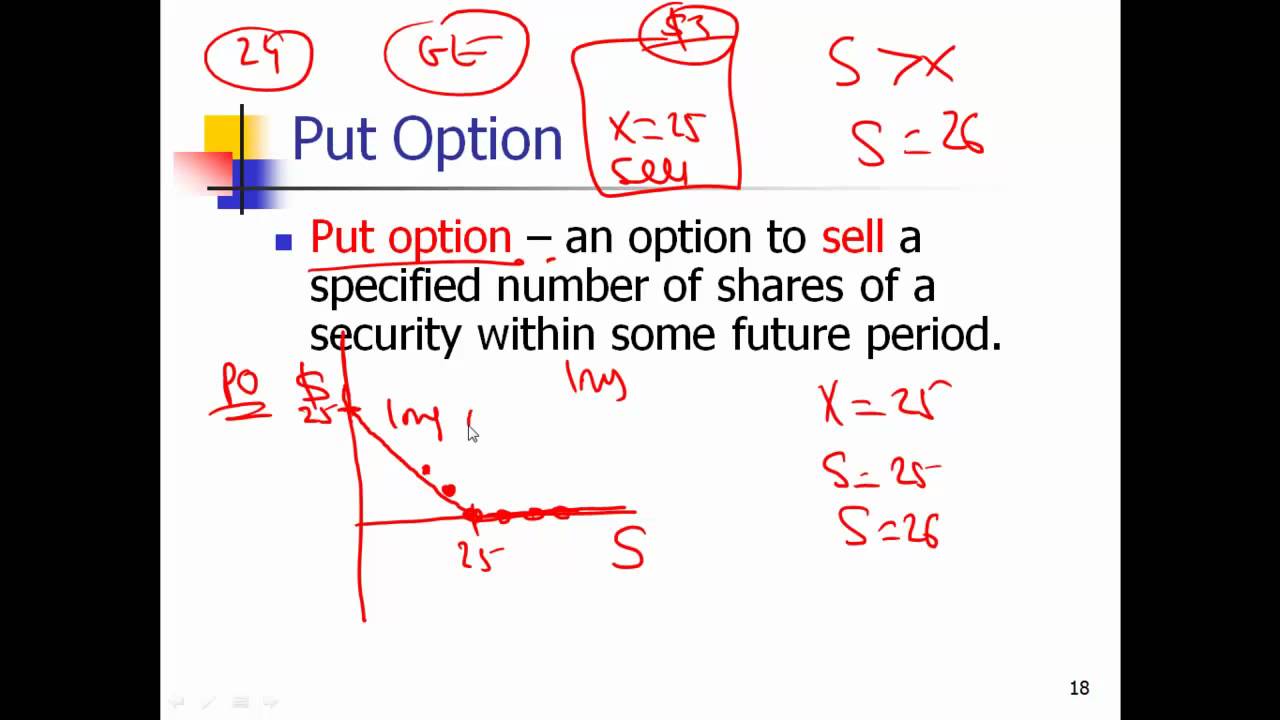

Find out how going long on a put option can lead to profits on a falling stock. @RISK Models. Projecting Oil Prices.

Minimum edition: @RISK Industrial. This model illustrates one possible way oil prices might change through time, as influenced by the market. We have created a macro based Supertrend Indicator excel sheet which calculates the indicator values and buy/sell signal in real-time.

The excel sheet is parameterized and works for all major exchanges. Excel Add-in for options pricing, implied volatility, historical volatility, monte carlo simulation, calculation of probabilities and more.Payoff Diagram Spreadsheet DownloadBinomial Tree, Cox Ross and Rubinstein (CRR), No Arbitrage and Risk Free Valuation.

European Call Option in Excel