Always start with separation of duties. Assign collection, recording, and reconciliation tasks to different individuals. No single person should handle incoming payments, update financial records, and review account balances. This division reduces the risk of errors and misconduct.

Implement a two-signature policy on outgoing payments. Require dual approval for all disbursements, whether via check or electronic methods. Use pre-numbered forms and maintain copies. Document approvals in writing, either physically or digitally, with a clear date and name associated with each sign-off.

Use a simplified visual guide to track accountability points. Include key checkpoints: reception of contributions, deposit process, ledger updates, and monthly reconciliation. Each stage should indicate the role responsible, the method used, and the timing. Opt for a linear flow with decision points and outcomes to clarify procedures.

Ensure bank accounts are reviewed independently on a monthly basis. The review should be done by someone not involved in bookkeeping. Provide bank statements, check copies, and deposit slips during this process. Identify discrepancies and investigate immediately, keeping notes of all findings and resolutions.

Templates and layouts for such frameworks can be adapted from open-access resources provided by CPA networks and governance training hubs. Customize based on team size and volume of activity, while keeping documentation consistent and centrally stored.

Essential Safeguards in Fund Oversight Systems Without Cost

Start by assigning all handling of monetary inflows to a single designated person, while ensuring that another individual is responsible for verification. This separation reduces the risk of misuse and fosters accountability.

Establish a structured workflow using the table below:

| Task | Responsible Role | Verification Method | Frequency |

|---|---|---|---|

| Receipt Logging | Treasurer | Daily entry in secured ledger | Every weekday |

| Donation Confirmation | Admin Assistant | Cross-check with bank deposits | Weekly |

| Disbursement Approval | Board Member | Written authorization form | Per transaction |

| Monthly Reconciliation | Volunteer Accountant | Compare statements and logs | Monthly |

| Annual Review | External Bookkeeper | Full-year financial analysis | Annually |

Use cloud-based spreadsheets with permission restrictions to keep shared records secure and tamper-resistant. Avoid giving any single individual end-to-end access to both collection and distribution processes.

How to Structure a Cash Flow Approval Process Using a Simple Diagram

Start by defining specific roles and permissions within your financial workflow. Assign clear responsibilities to prevent overlap and ensure accountability.

- Step 1: Request Initiation

- A staff member submits a funding request using a standardized form.

- Include date, purpose, vendor details, and amount requested.

- Step 2: Initial Review

- Department head reviews the request for completeness and alignment with the budget.

- If approved, the form moves to the second tier; if not, it is returned with comments.

- Step 3: Financial Oversight

- A finance officer verifies available funds and compares the request against monthly allocations.

- Transactions exceeding a threshold (e.g., $1,000) require dual authorization.

- Step 4: Final Authorization

- The executive director or board treasurer gives the final sign-off.

- This step includes digital or physical signature with a timestamp for recordkeeping.

- Step 5: Disbursement & Recording

- Funds are released only after approval is documented in the ledger.

- Maintain digital copies of all signed forms and receipts linked to the request ID.

Represent this sequence visually using boxes connected by arrows, labeling each with the role responsible and required action. Limit the total number of stages to five to keep the flow concise and auditable.

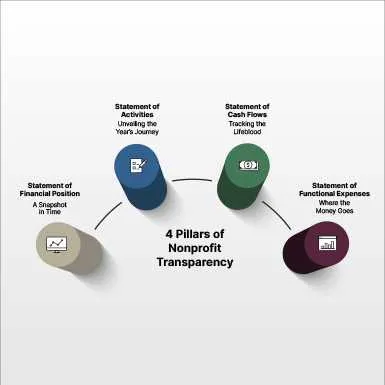

Steps to Create a Visual Chart for Money-Handling Duties

Start by listing every task tied to the flow and oversight of funds–e.g., accepting incoming payments, issuing receipts, making deposits, and performing reconciliations. Assign each action to a specific role rather than a person to ensure clarity and adaptability.

Use a table or grid format to map each function to a responsible position. Avoid overlap by ensuring no single role manages two conflicting stages of the cycle, such as both recording and verifying transactions.

Incorporate directional arrows to show the sequence of duties, using consistent symbols to distinguish between oversight, execution, and verification. Include checkpoints such as dual-signature requirements or independent reviews where needed.

Design the chart using software like Lucidchart, Draw.io, or even Excel, and make it printable. Place the finalized version in a shared, visible location and update it when roles shift or processes change.

Free Tools to Design and Share Internal Cash Control Diagrams

Start with draw.io (also known as diagrams.net). It’s browser-based, doesn’t require sign-up, and supports exporting visuals in PNG, PDF, or SVG formats. Use built-in templates to map out task sequences, approval steps, and segregation of duties.

For collaborative editing, switch to Lucidchart’s free tier. It includes real-time sharing, access permissions, and basic shape libraries. Focus on linear workflows and clearly labeled decision nodes to keep things readable.

Need version control or team input? Use Google Drawings. It integrates with Google Drive and allows multiple users to comment or revise in parallel. Add arrows, text boxes, and color-coded steps to differentiate roles or stages.

If you want an open-source option, install Pencil Project. It runs offline and supports exporting to multiple formats. Use stencils to define entry points, verification actions, and reporting flows without clutter.

To publish or embed, rely on Canva’s free plan. While it’s not purpose-built for technical schematics, its drag-and-drop canvas and icon sets make it easy to create presentation-friendly layouts. Export as PDF or generate a public link for sharing.